Are compound and cumulative dividends the same thing?

Are compound and cumulative dividends the same thing?

Every investor loves the word “dividend.” Stocks in general and especially the so-called “dividends kings” stocks often pay dividends making that stock more attractive. Commercial real estate investments are furthermore attractive when dividend payout is offered towards the investor’s benefit. There are two basic dividend payouts, and investors may not fully understand the nuances of dividend types, and therefore I wanted to explain it.

Dividends that are paid out to investors can be either cumulative or compound or both.

First, let’s list the terms associated with dividend distribution, and then we will move on to flesh out these terms with actual examples, which will will help you make a more informed decision when reviewing the next investment offering. Normally, returns from dividends are calculated as a percentage of the original investment.

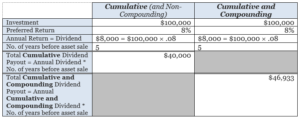

Dividends can be either Cumulative and Non-Compounding or Cumulative and Compounding (or just Compounding).

Here is where an investor may unknowingly use these terms interchangeably, and will therefore miss out on the full benefit of their differences, and there may indeed be a big dollar difference. So later in this article we will go over a couple of dividend calculations to help you hold your own during contractual discussions.

Cumulative in this sense means that the dividend is just based on the original per-share price, while Cumulative and Compounding means that the dividend is not only based on the original per-share price, but also includes the amount that accrues over time.

This difference is shown in the table and the figures below.

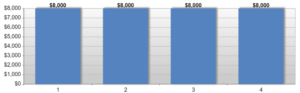

As you can see in the table above and in the bar graph below, a simple Cumulative Dividend will have earned the investor $8,000 annually, and the total dividend payout after 5 years will be $40,000.

However, using the same original investment and dividend percentage, but instead calculating Cumulative and Compounding Dividend calculation, the 8% annual dividend will have earned the investor $46,933 in dividends.

Obviously, there is a sizeable difference between Cumulative and Compounding Dividend. However, even more importantly you learned something new that will ensure your understanding of an investment offering you are reviewing in the future.

Have you thought about passively building your wealth via real estate investing?

Let’s talk