What are the Four Investor Quadrants?

What are the Four Investor Quadrants?

Making decisions sporadically and without a plan has never produced quality results. The same is true for making real estate investment decisions and choices. You need to be analytical throughout the investment process, starting with educating yourself first on the real estate investing, various options available, and then deciding what type of investment suits your goals best!

In order to make intelligent decisions about real estate investing, you should understand the types of investment choices that are out there and match them with your long-term plans. My partner, Mike Zlotnik, has developed The Investor Quadrant methodology, which we share with our investor community. Let’s go over this methodology, so that you could leverage it for your investment needs.

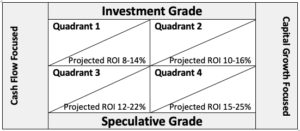

The quadrants are located from left to right in the numerical order with Quadrants 1 and 2 being on the top and Quadrants 3 and 4 being on the bottom.

The left side of the quadrants focuses primarily on Cash Flow and not as much on Growth, while the right side is focused predominantly on Capital Growth and less so on Income.

The upper row of the quadrants is the investment grade and hence tends to include moderate to low risk types of investments, while the bottom row of quadrants includes speculative grade and hence applies to higher risk investments.

When evaluating any projects, the first step is to determine whether it is income- or growth-focused, followed by determining the investment risk level. This process allows you to place each investment into one of the four categories, which in turn helps you decide whether this is the type of the investment that suits your particular financial needs.

Let’s review each of the four quadrants in greater detail to break down the process for classifying each type of investment.

Quadrant 1

- Includes institutional-quality deals

- Investments fall into low to moderate risk categories

- Deals offer cash flow from day one

- Examples include, but are not limited to performing notes or first lien mortgage notes or super conservative leverage equity deals

Quadrant 2

- Includes institutional-quality deals

- Investments fall into low to moderate risk categories

- Deals offer limited to no cash flow initially

- Examples include, but are not limited to non-performing notes or moderate leverage value-add deals

Quadrant 3

- Includes speculative-quality deals

- Investments fall into higher-risk category with higher degree of uncertainty

- Investments initially project higher cash flow and concentrate on generating income

- Examples include, are but not limited to second lien performing notes or high leverage value-add deals or mezzanine debt fund

Quadrant 4

- Includes speculative-quality deals

- Investments fall into higher-risk category with higher degree of uncertainty

- Investments initially project limited cash flow and concentrate on multiplying value down the road

- Examples of such deals include but not limited to development, major re-development, land speculation, as well as heavy value add projects with low or non-existent initial cash flow

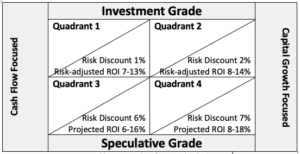

Keep in mind that all projects have risks, and you need to understand how to calculate returns that are adjusted for probable risks. In order to achieve that, you need to subtract the risk discount/loss reserve from the projected return.

The high-level guidance for risk adjustment or loss reserve ranges approximately 1-3% (average is 2%) for investment-grade projects and 5-20% (average is 6-8%) for speculative-grade projects. As you can imagine, the speculative-grade deal risks are much higher, and hence they also offer higher projected returns. It is not uncommon for these guidelines to vary significantly further depending on factors, including market fluctuations, sponsors, project-specific risks, such as insufficient capital risk or higher construction cost, and on many other factors. The values below are used specifically for illustration purposes to explain the methodology and the risks involved.

So, the table above illustrates the examples of potential risk discounts for each of the four quadrants categories and the risk-adjusted returns based on such discounts. As you can see from this example, the risk discounts associated with the speculative grade projects maybe a lot higher and hence the returns may end up being lower than the returns for the investment grade projects. Therefore, a lot depends on your investment portfolio, your short- and long-term goals, your investment risk tolerance to potentially generate much higher returns.Table 1 – Examples of Potential Risk Discounts

As mentioned above. there are no set-in stone values, and the intent here is to give you a general guidance to understand the various investments, the associated risks, and to keep realistic expectations of the potential returns and losses.

Your question now is most likely, “Which one is best for me?” Only you know what is best for you. We can help you determine your portfolio building strategy.

If your main objective is capital preservation, then you are most likely a conservative investor looking for investments with lower volatility. Hence you would benefit from a well-diversified fund that invests in a variety of projects. Keep in mind, the diversification may apply to geographic locations, investment strategies or various real estate asset classes. So, each fund may incorporate one or two or all three of these diversification strategies. The more diversification strategies are implemented within each fund, the higher the actual hedge against volatility such fund offers.

Some examples of a single strategy funds include a fund focused on multi-family or mobile home parks. When it comes to individual asset syndication deals, the risk is also higher than in a fund due to the diversification reasons that we just discussed. If anything goes wrong with this single project, then you are likely to not receive any dividends or potentially lose some or all of the principal funds you had invested. In a fund, the risk of all or even most projects failing is fairly low, and hence the volatility is a lot lower than that of a single asset investment.

Let me use a specific example. Let’s say that two individuals, Ella and Frank, have $200k to invest. Ella decided to invest all $200k in a fund that diversifies across all three investment strategies, while Frank invested in four different single asset syndications. Guess, which investments have lower risks and higher hedge against the investment’s volatility? You guessed correctly – Ella’s.

We frequently use these investment quadrants to teach our investors how to make better informed investment decisions, and I hope it certainly shed some light on the investment methodology for you as well.

Have you thought about passively building your wealth via real estate investing?

Let’s talk