The beauty of J-curve in Private Equity Funds

The beauty of J-curve in Private Equity Funds

When most people hear the term “J-curve” they instantly realize that it has something to do with the letter “J”. But what makes this letter so special when it comes to real estate investing?

Well, it turns out that the shape of the letter “J” offers a fairly accurate representation of the correlation between income and expenses in a typical private equity growth fund. Let’s explore what I mean by this.

When a fund management team starts a new growth fund, the team members typically source projects that can benefit from a substantial value-add plan with the objective of generating strong returns. However, since the plan takes time to execute, these returns may often begin years down the road. Projects at their most basic form consist of this life cycle: buy or invest in a property, execute the value-add plan (renovate, develop, re-develop, expand, etc.) increasing the value of investment, and sell it. But what happens at the beginning of these projects’ life cycle?

Let’s take a look at a typical a heavy multifamily value-add project (take a look at this short video to learn more about multifamily value-add topic). When a property is initially acquired it must undergo a renovation, which may include fully renovating and modernizing some or most of the units, undertaking exterior construction projects such as replacing roofs, siding, or adding a covered parking, or beautifying the common areas by adding a garden or a playground. While a property is being renovated, or as it is commonly referred to as going through “repositioning”, income typically decreases because of ongoing construction expenses and temporary vacancies, and this is especially true during renovation of units.

As you may already know, the value of a commercial real estate is typically based on the Net Operating Income (NOI) formula, which is simply the remaining operating income after deducting all operating expenses (take a look at this short video about the NOI topic).

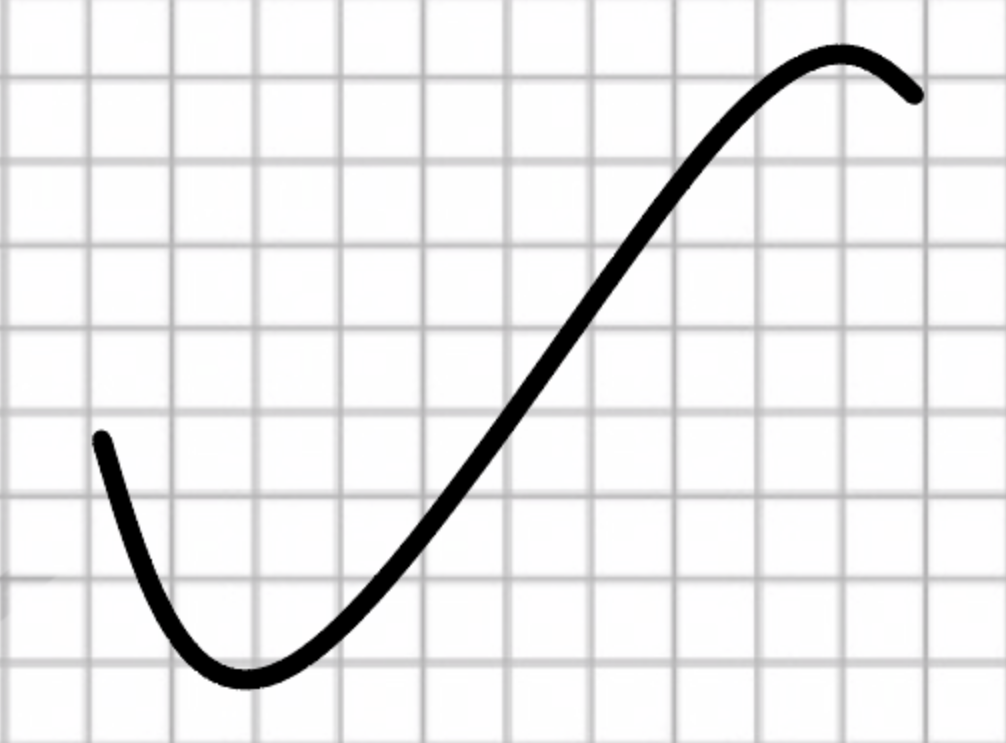

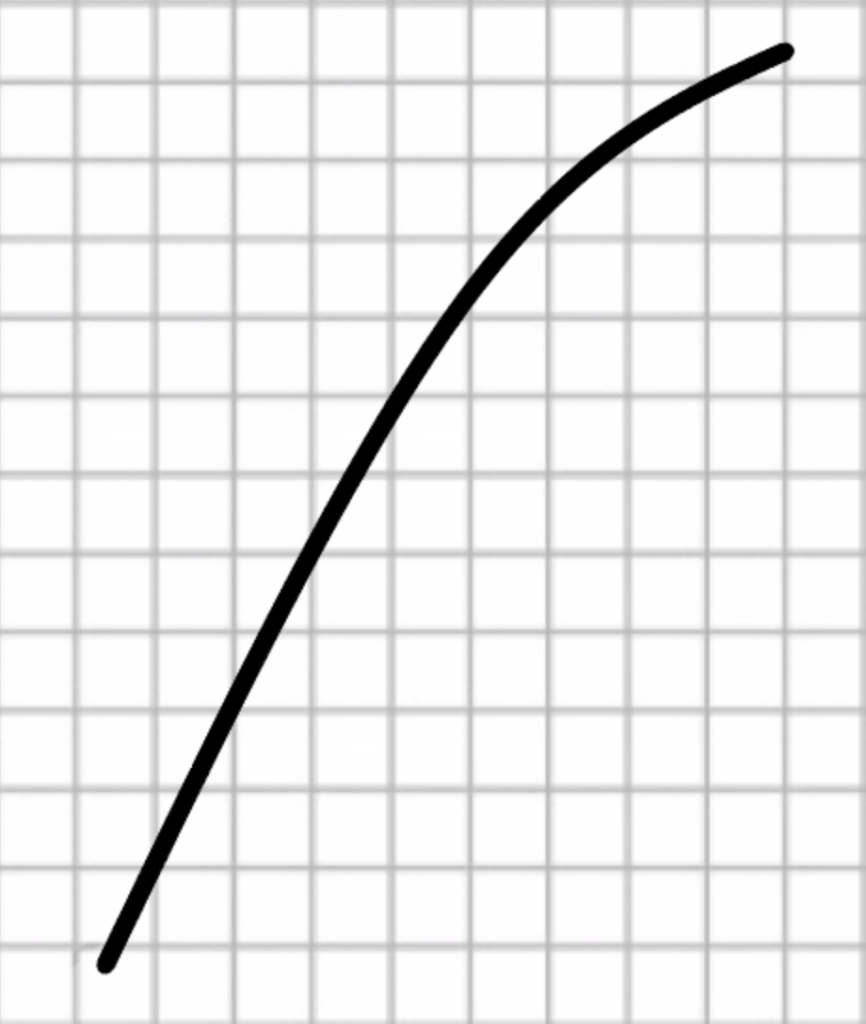

So, when the property is being renovated, the value-add project may incur heavy expenses, which in other words means that the property generates a loss, and its value is decreasing during its repositioning. Many re-development projects, such as hotel conversions to multifamily, initially experience a substantial drop in their value due to the massive negative income (losses). Again, these losses occur because these properties stop functioning as hotels and their normal rental income stream is interrupted while going through the renovation or the re-development phase. This early stage equates to the beginning of the bottom right of the J-Curve, and the cumulative income (driven by the operating losses during the heavy re-development phase) decreases and the value of the project is dropping, hence it looks like this:

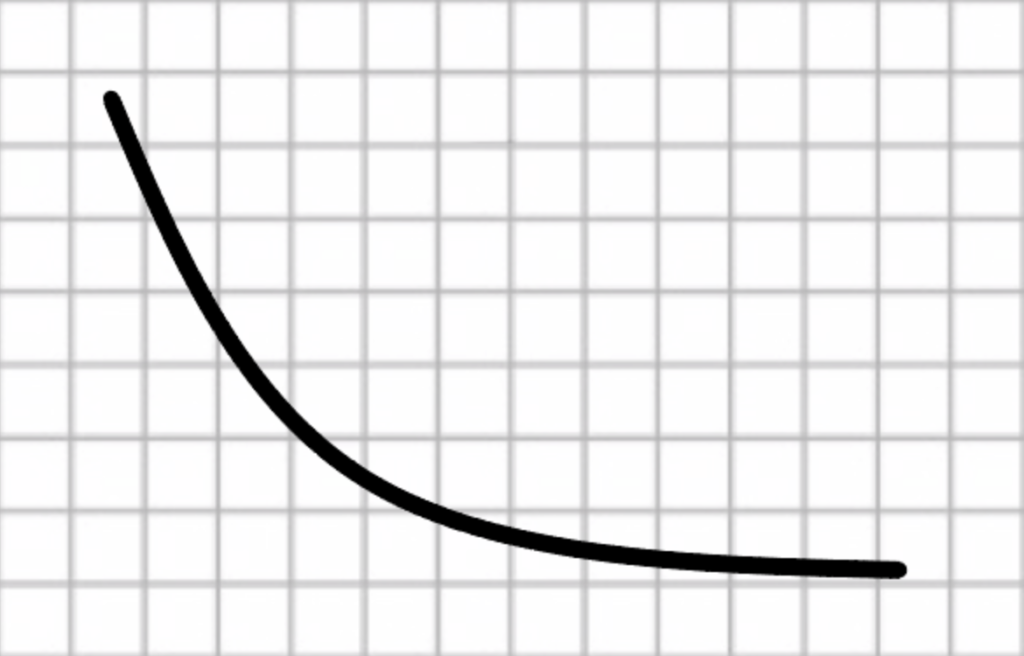

As the project proceeds and matures, and as the renovation expenses decrease, NOI gradually increases signifying a growth in the property value. Hence, it pushes the J curve line to gradually rise as well, like this:

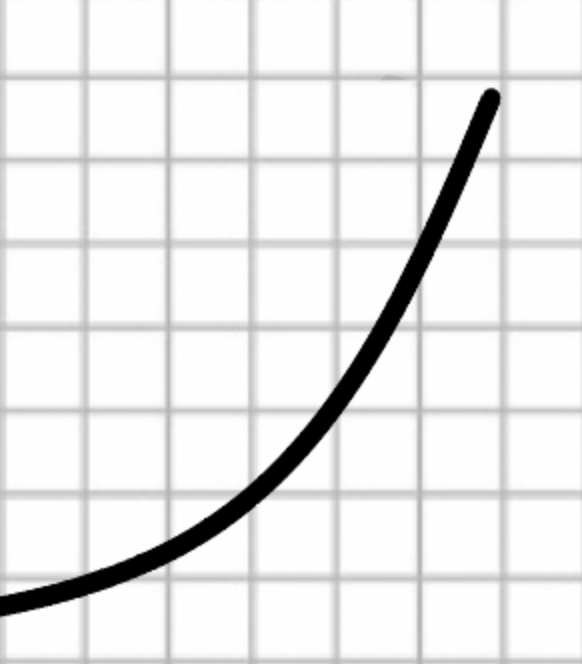

Now, imagine that there is not one, but many similar projects in your portfolio. Yes, you guessed it – the initial renovations timeline would have to be more or less similar for all these projects to go through the identical stages around the same time or you may potentially have more than one deep dive. That is why most acquisitions take places at the early stages of building the growth-oriented portfolio: property values are lower at this phase. But as we said earlier, essentially the idea is that you buy or invest in a property, renovate it, and then as the repositioning is close to being completed, the income as well as the value of your property increase. Your J-curve will continue rising until the point where you decide to sell the property, and at this point the J-curve would look like this:

You might be wondering about the benefits of this type of a delayed gratification strategy. Why would you want to invest in a growth fund? After all, it is likely to lose value almost immediately after you invest your money, and it may take years for the investment value to grow. There are indeed several excellent reasons.

Aside from the obvious reason that value add projects are structured to generate investment returns when the property sells, there is an even better reason.

One of the primary reason for investing in value-add projects is that they may offer significant tax advantages.

How? The value-add projects in the portfolio offer passive losses through the depreciation of the properties. Moreover, in many cases, they may offer bonus depreciation by executing the cost segregation study and hence increasing the upfront amount of the depreciation which in turn typically turns into greater losses. All these depreciation losses can then be written off against other projects that produce income for the investor, lowering their overall investment tax burden. You should always consult with your CPA when considering any tax strategies as articles such as this one are geared to educate you on what’s possible and it is up to you to decide what to do and how to best execute it.

So, imagine to be able to generate massive returns on exit and simultaneously save on taxes.

Obviously, the investment in a growth fund or an individual growth project needs to go through the proper due diligence. You are investing for the best “risk adjusted return”. Each project and/or fund must first make strong economic investment sense, and only then should consider the benefits of the “J” curve.

So, “Where does calculated risk come from?”, you may ask. Well, among the many points of evidence that you should examine, a great place to look are the calculated project projections that take into the consideration the actual results from the last 12 to 24 months of the deal’s income statements.

Now, managing a portfolio of diversified assets is no easy job, and as you likely had heard me say many times before, it is typically handled best by an experienced fund manager or a fund management team, such as Tempo. If you are ready to learn more about the many benefits of real estate investing, and how our experienced fund management team can help you diversify your portfolio, please reach out to me and I will be happy to speak with you.

Have you thought about passively building your wealth via real estate investing?

Let’s talk