Step By Step Process on How To Invest In a Real Estate Syndication

Alina Trigub2020-12-28T03:14:53+00:00If my article, The Power of Passive Real Estate Investing, peaked your interest about becoming an equity partner in a syndication, then read on to find out more detail. Similarly, while the questions posted in my follow-up article, Where to Begin When it comes to Passive Real Estate Investing, were meant to inspire you to research the benefits of passive real estate investing, I am happy to further unpack these and other topics. In short, offer a step-by-step process for investing in a real estate syndication.

Step 1. Set up your investing goals and decide whether you will be an active or passive investor

When you are setting up your real estate investment goals, you need to decide how much time can you devote to managing real estate investments activities. The questions that you need to come to terms with include:

Do you want to be involved with day-to-day investment tasks?

Do you need to have full control of your investment’s direction?

Do you have a lot of free time to manage your assets?

If you answered “Yes” to any of the questions above, then you should evaluate taking a more active route.

For my family’s lifestyle, I originally selected to be a passive investor. Take a peek at the benefits of passive investing outlined in my article, The Power of Passive Real Estate Investing, to get a better understanding the differences between the approaches for active and passive real estate investing.

As a case study, let’s say that you are married with two pre-teen or teenage kids. Both you and your spouse hold full-time jobs, and your evenings are spent ferrying your children to and from their activities. You can probably guess that my suggestion to you is to explore passive investing. The bottom line is if you want to pursue other endeavors in life, such as a family, a full-time job, your own business, or a time-heavy hobby, and your time spent on investing will be limited, then syndications are the right fit for you.

After you decided that syndication is the way to go for you, then move to step two.

Step 2. Determine where to get your funds

CASH IS KING! When it comes to investing, you must have the funds ready; most syndication investment offerings are quickly filled, and they normally require a minimum of $50,000. If you have this amount in liquid cash, you are on your way, otherwise continue building your cash reserves until you have at least $50,000 allocated specifically for investing and NOT for a rainy day!

IRA DIVERSIFICATION. If you are not a “cash person”, look into your IRA accounts as an alternative; either your Roth IRA or Rollover IRA is a great candidate for a source of funds. Determine whether you can transfer all or a portion of either or both types of IRA accounts into a Self-Directed IRA Account (SDIRA). My article, Invest With IRA funds, will lay out the basics of SDIRA benefits. SDIRA accounts are normally offered by custodians, which are basically financial companies that allow to invest in assets other than stock market. I use a SDIRA myself to invest in real estate, and there are many other assets in which you can invest, although IRS is very clear about certain items in which IRS disallows investing via SDIRA.

PUT YOUR BUSINESS TO USE. Another viable option to keep in mind when determining what funds to invest in real estate is whether you have your business. Having your own business along with some other requirements allows you to open a Solo 401K account. While it is not a secret most people have never heard of Solo 401k. So, it is essential to educate yourself and determine what will be the source of money to fund your investments. Once you made the decision, ensure the funds are either moved from IRA to SDIRA provider or you have had the time to set up a solo 401K.

DON’T FORGET. When gathering your funds, it is important to have enough funds to invest in different asset classes to protect yourself from market fluctuation. Take a quick read through my primer on diversification in Don’t Put All Eggs In One Basket.

Step 3. Identify which opportunity fits your goals

In order to determine which syndication opportunity is a good fit for your goals, you need to properly evaluate it. Syndicators (also called deal sponsors) provide an Executive Summary (aka Offering Memorandum) as part of the offering to invest in a real estate syndication. For a “summary” it is a fairly lengthy 20-to-30 page document detailing the market, the investment, the comps, the surrounding area, why this particular investment is a good deal, pros and cons, the underwriting model for X many years with projections, potential exit strategies, the breakdown of fees, and a brief biography of all syndicators.

In addition to the executive summary, some syndicators offer webinars on their investment offerings.

By all means, you should also do your own research based on the information provided for each particular investment. I compiled a list of additional questions to ask deal sponsors in my article, “Questions To Ask a Syndicator”.

Step 4. Follow the syndication process by committing to a specific investment

Once you finish evaluating a deal and you are ready to move forward with investing in a particular syndication, you need to advise a syndicator of your decision. Once again, usually when the deal is particularly enticing, it will fill up and close pretty quickly. I have seen many deals fill up in a matter of a few days, with a long waiting list of investors!

As you gain experience, you will be able to do your homework ahead of time. This tactic requires a level of proactive evaluation. Once you determine which deal sponsors interest you, then do your due diligence and evaluate these syndicators ahead of time. Syndicators will be happy to speak with you and answer any questions about them and their team. This due diligence can be done as a part of step three.

Step 5. Review and sign the legal paperwork

Reviewing the legal documents for an investment can be a daunting exercise. However, even after you decided to invest in a deal and have reviewed the Executive Summary, it is critical to take your time to carefully review the Private Placement Memorandum (PPM), which is essentially the main document in a syndication. It covers all major components of a syndication; the structure, the breakdowns, the investment amounts, and the fees. If you do not understand certain parts of PPM, reach out to the syndicator for clarification.

Take a look at this article detailing the legal documentation in a syndication, “Securities Offering Documentation”.

Step 6. Wire funds

Once all legal paperwork is reviewed, completed, and signed, it is time to transfer the money to fund your investment. Normally this process is handled trough a wire transfer to a bank using the wiring instructions provided by the syndicator.

I cannot stress enough that if you do not understand certain items in the wire transfer process, always ask.

Step 7. Most importantly – Have a great time celebrating your investment!

The last and final step, after all set and done, is to celebrate the moment! Congratulations – you invested in your syndication. Now it’s time to start searching for your next Perfect Investment.

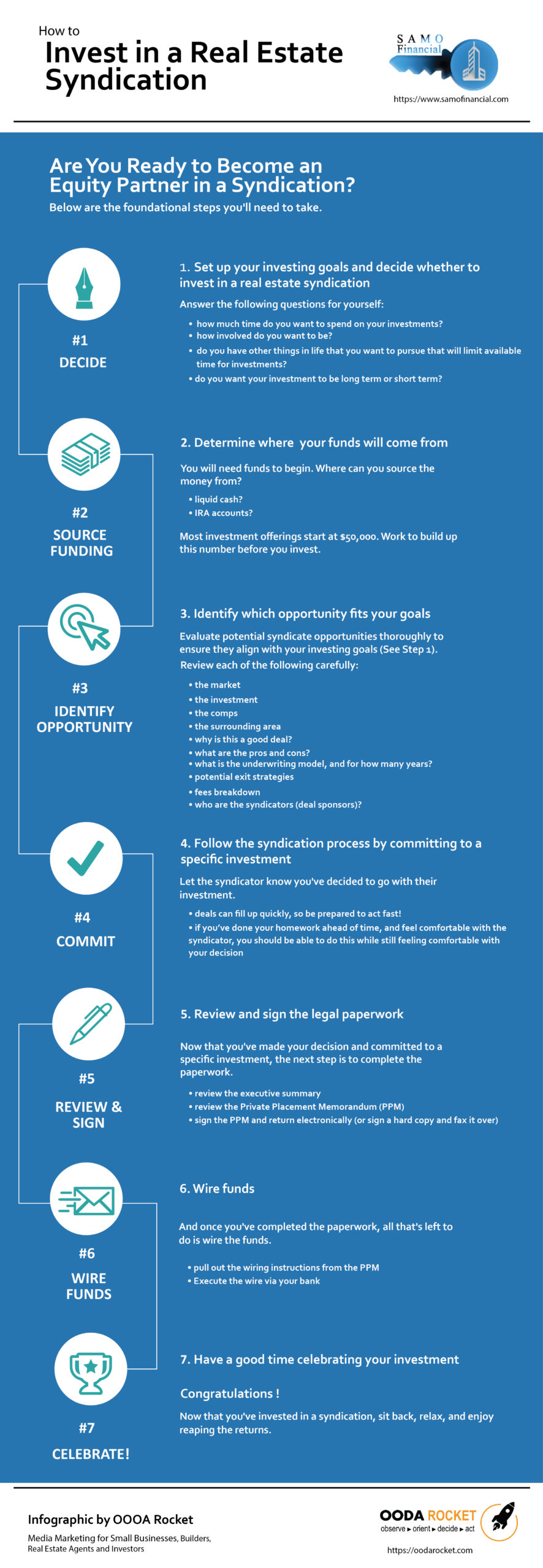

Below is the infographic to demonstrate the process: